Instances of harassment and debt shaming by digital lenders have decreased as a result of collaborative efforts to instill order in the sector. Spearheaded by the Office of the Data Protection Commissioner (ODPC) and the Digital Financial Services Association of Kenya (DFSAK), these initiatives have yielded positive outcomes.

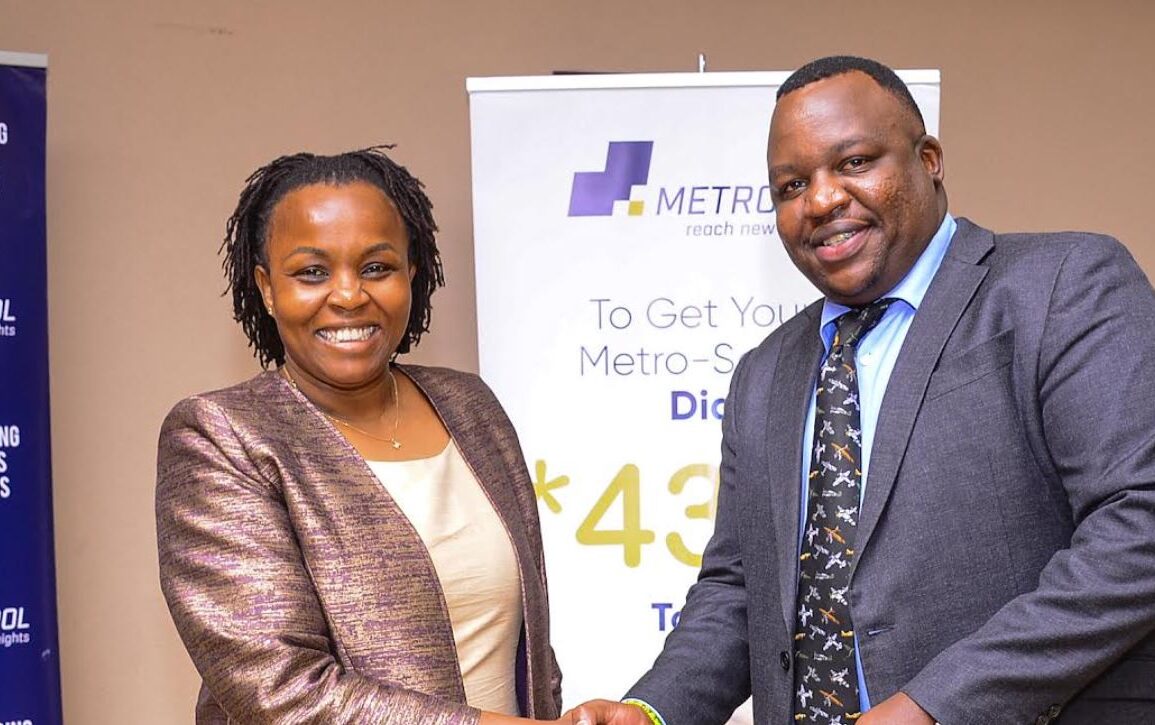

During a sensitization session held at the Serena Hotel in Nairobi to educate lenders on compliance guidance notes, Data Protection Commissioner Immaculate Kassait highlighted a significant reduction in complaints against financial service providers since the Central Bank of Kenya introduced a regulatory framework two years ago.

Recently, the German International Cooperation (GIZ) and Financial Sector Deepening (FSD) jointly sponsored the implementation of guidance notes to aid digital lenders in adhering to regulations, particularly concerning data protection.

“We have been working collaboratively with the ODPC to ensure customer protection. This has led to a significant decline in harassment by over 74 percent. The practice of debt shaming is nearly eradicated, and those who continue to harass customers do so at their own peril,” said Kevin Mutiso, Chairman of DFSAK. “A collaborative approach between regulators and the industry is crucial to achieving

mutually desired outcomes.”