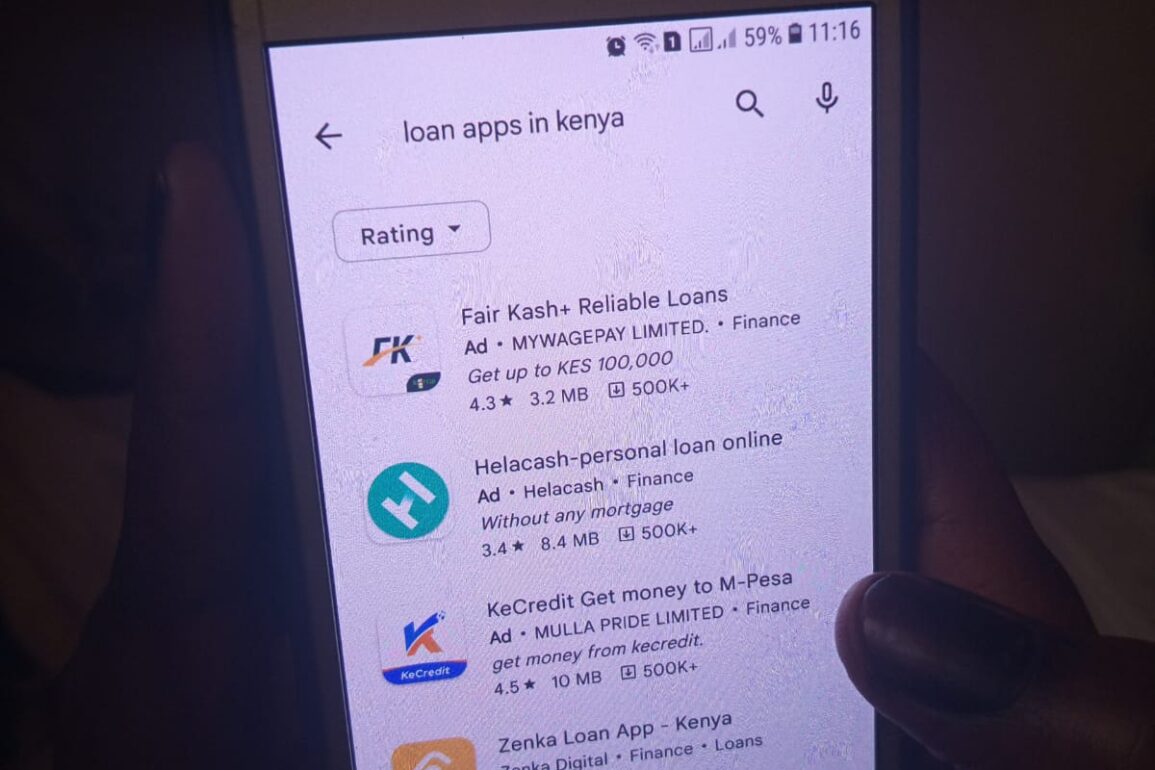

In Kenya, loan apps have become a popular way for cash-strapped customers to access credit without collateral.

The convenience of being able to access cash via M-PESA on their phones in a matter of seconds has made digital lenders highly successful in the country.

Currently, there are 32 licensed digital lenders, as the Central Bank of Kenya (CBK) recently added 10 more loan apps to its approved list.

CBK had received over 380 applications and is still assessing them.

The 32 approved loan apps are:

1. Anjoy Credit Limited

2. Asante FS East Africa Limited

3. Ceres Tech Limited

4. Colkos Enterprises Limited

5. EDOMX Limited

6. Extend Money Service Limited

7. Fourth Generation Capital Limited

8. Getcash Capital Limited

9. Giando Africa Limited (Trading as Flash Credit Africa)

10. Inventure Mobile Limited (Trading as Tala)

11. Jijenge Credit Limited

12. Jumo Kenya Limited

13. Kweli Smart Solutions Limited

14. Letshego Kenya Ltd.

15. Little Pesa Limited

16. MFS Technologies Limited

17. M-Kopa Loan Kenya Limited

18. Mwanzo Credit Limited

19. Mycredit Limited

20. MyWagepay Limited

21. Natal Tech Company Limited

22. Ngao Credit Limited

24. Pezesha Africa Limited

25. Rewot Ciro Limited

26. Risine Credit Limited

27. Sevi Innovation Limited

28. Sokohela Limited

29. Tenakata Enterprises Limited

30. Umoja Fanisi Limited

31. Zanifu Limited

32. Zenka Digital Limited.