While global blockchain funding continues its recovery, Africa has emerged as a breakout performer, commanding a much larger slice of its venture capital (VC) pie than any other region, according to the newly released CV VC African Blockchain Report 2025.

The report reveals that although blockchain accounts for just 3.2% of total VC funding globally, it commands a significantly higher 7.4% share of all venture capital raised in Africa, more than double the global average. This surge reflects not just growing investor interest but a deepening recognition of blockchain’s potential to solve uniquely African challenges.

“Blockchain technology is uniquely suited to solving niche African problems,” said Jarryd Kennedy, Head of Investments at CV VC Africa. “African founders are showing the world how blockchain addresses real-world challenges like data sovereignty, efficient remittances, provable identity, inaccessible credit, and verifiable land ownership. As more success stories surface, investor confidence continues to rise.”

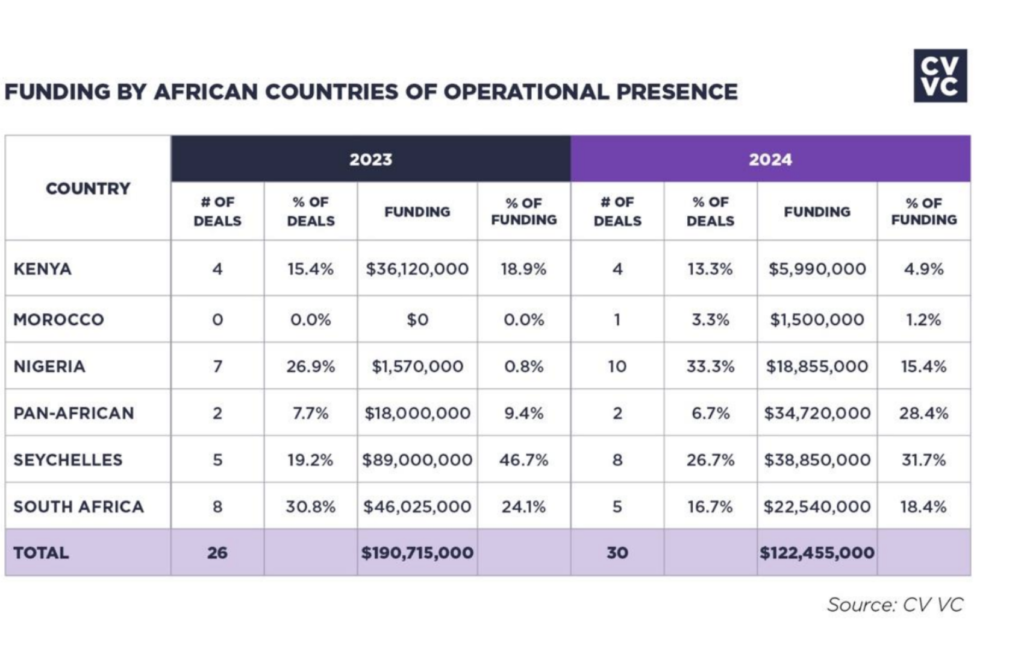

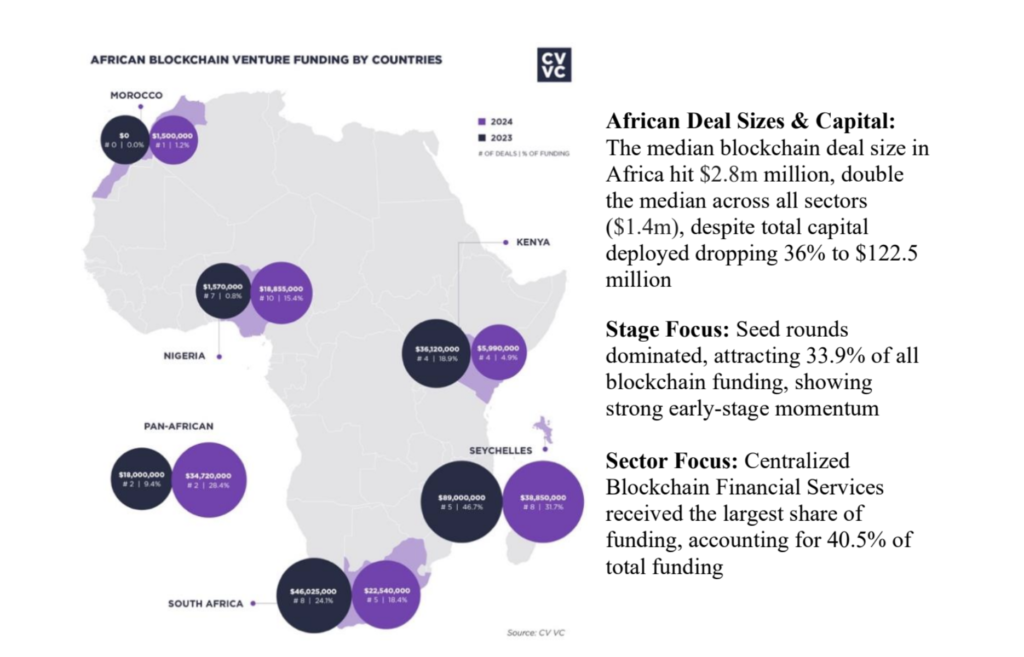

Africa led all global regions in blockchain deal growth in 2024, posting a 15% year-on-year increase. This comes despite a 36% drop in overall capital deployed to African blockchain startups, which totaled $122.5 million. Still, the continent’s median blockchain deal size hit $2.8 million—twice the median across all startup sectors ($1.4 million)—signaling strong early-stage momentum and confidence in scalable solutions.

Key Highlights from the 2025 Report:

-

Global Landscape: Blockchain startups globally saw a 6% increase in deal count and a 14% rise in total funding. Globally, a total of $12.1b across 1,309 deals in 2024 was raised, from $10.6b across 1,231 deals in 2023. Blockchain VC accounted for 3.2%

of all global venture funding in 2024 and 5.6% of all global venture deals. -

Africa’s Position: Total general venture funding was $1.6b in Africa across 236 deals in 2024, marking a YoY decline of 39% (from $2.7b) and 34% (from 358), respectively. Africa’s global share of blockchain deal count rose to 2.3% (from 2.1%), while its share of global blockchain funding slipped to 1% (from 1.8%). The 2024 median deal size was $2.6m (+3% YoY), 35% below the global median, and nearly double (93% higher) the all-sector African median of $1.4m.

-

Regional Focus: Within Africa, blockchain now accounts for 7.4% of total VC funding (up from 7%) and 12.7% of total startup deals (up from 7.3%). There was $122.6m in blockchain VC funding, down 36% YoY, across 31 deals, up 19% YoY. Q2 had the most deals (42%), Q3 raised the most capital (33%).

-

Market Leaders: Nigeria led with 33% of deals, followed by Kenya at 13%. South Africa captured 18% of funding, while Pan-African startups attracted a commanding 28.4%, reflecting investor appetite for scalable, cross-border platforms.

-

Sector and Stage Focus: Centralized Blockchain Financial Services received the largest funding share (40.5%). Seed rounds dominated, securing 33.9% of all blockchain capital raised.

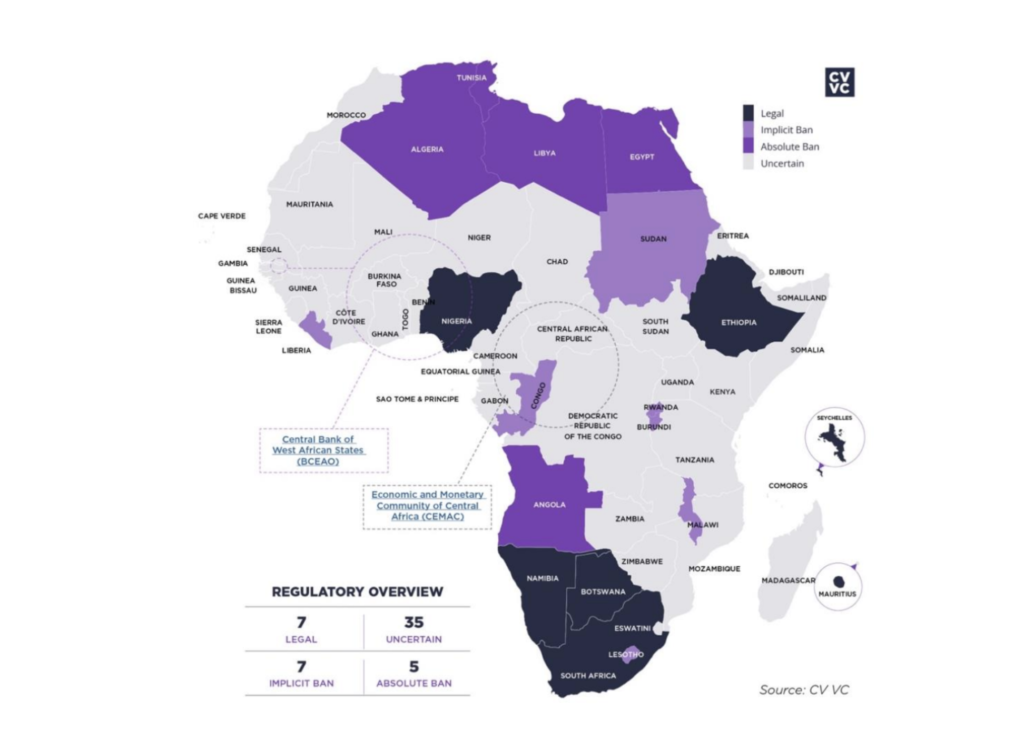

- Regulation: Of Africa’s 54 nations, 7 countries—South Africa, Nigeria, Ethiopia, Botswana, Namibia, Mauritius, and Seychelles—have established legal frameworks for digital assets. 35 countries, such as Ghana, Kenya, Morocco, Tanzania, Uganda, Senegal, Zambia, and Zimbabwe, maintain an uncertain or undefined regulatory stance. 7 nations—Rwanda, Liberia, Republic of Congo, Sudan, Burundi, Malawi, and Lesotho—have implemented an implicit ban, while 5—Angola, Egypt, Libya, Algeria, and Tunisia—enforce an absolute ban on digital assets.

Beyond fintech: Blockchain in Africa’s real cconomy

The report signals a decisive shift: blockchain in Africa is no longer restricted to digital assets and fintech. It’s becoming a key enabler of progress in critical sectors, particularly agriculture, which employs more than 60% of the continent’s workforce.

Blockchain is now tackling Africa’s estimated double-digit billion-dollar food export losses by improving supply chain traceability. By recording farmer identities and crop histories on-chain, the technology helps meet stringent new EU import standards, such as the €7.5 billion requirement for proof of zero deforestation and ethical sourcing by 2025.

Blockchain also enables climate action monetization. Smallholder farmers using blockchain-verified carbon tracking can earn up to $300 more per year, enough to send two children to school. As global food brands chase environmental, social, and governance (ESG) targets, Africa stands poised to lead the emerging green food economy.

“Africa isn’t testing blockchain, it’s embedding it where it matters most for the future of humanity,” said George Maina, CEO of Shamba Records. “In agriculture, we’re blending regenerative wisdom with blockchain transparency.”

Regulation: From risk to opportunity

The regulatory landscape is also evolving. Seven African countries now have formal digital asset regulations, and another 35 are actively developing frameworks, a shift from regulatory hesitation to proactive policy-making.

Yet Africa still captured just 1% of global blockchain funding in 2024, highlighting a glaring disconnect.

“This isn’t just an investment gap, it’s an opportunity gap,” said Mathias Ruch, CEO of CV VC. “Africa isn’t underperforming. Global capital is under-participating.”

With 25% of the global population projected to live in Africa by 2050, along with 65% of the world’s arable land and nine of the 20 fastest-growing economies, the stakes are high. As mobile and blockchain infrastructure leapfrogs traditional systems, African founders are not merely adapting global innovations, they are forging their own paths.

“This report highlights a continent in motion,” said Rob Downes, Head of Digital Assets at Absa Corporate and Investment Banking. “African innovators are solving deeply rooted challenges with blockchain, from trade bottlenecks to agricultural transformation. Absa is pleased to be an active contributor and believes blockchain will be central to Africa’s digital economic leap.”