Stablecoins—tokenized versions of fiat currencies operating on blockchains—have emerged as crypto’s undeniable competitor across the world to date.

This is according to the recently released Stablecoins: The Emerging Market Story report sponsored by Visa, which details the rising demand for stablecoins in Brazil, Turkey, Nigeria, India, and Indonesia.

Despite crypto market downturns in 2022-2023, stablecoin volumes have grown consistently, suggesting their adoption extends beyond crypto exchange settlements to a broader user base.

The report reveals that there are currently over $160 billion worth of stablecoins in circulation globally, a significant increase from just a few billions in 2020. More than 20 million wallet addresses, the study adds, conduct stablecoin transactions on public blockchains every month.

In the first half of 2024 alone, stablecoins settled an estimated $2.6 trillion in value, projecting to $5.28 trillion by the end of the year. Last year, stablecoins settled $3.7 trillion worth of value. In March, USDT (Tether), the stablecoin held by over 95% of users, crossed the $100 billion mark in circulation, hitting $122 billion in one day.

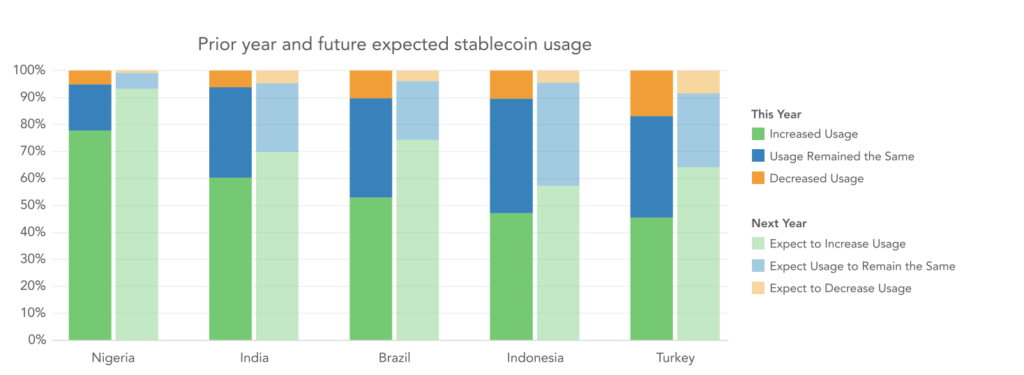

SOURCE: VISA Stablecoin Report in Emerging Markets

Initially, stablecoins were used primarily as collateral and a settlement medium for crypto traders and exchanges. However, they have since gained widespread adoption across the global economy.

It’s evident that users around the world appreciate the ability to hold tokenized representations of fiat currencies—mainly the USD—in their own custody, bypassing the need for potentially unreliable or inaccessible bank accounts.

Stablecoins offer notable advantages compared to traditional payment systems, such as native programmability, enhanced auditability, fast settlement, self-custody options, and seamless interoperability.

Stablecoins are also being increasingly used for cross-border payments, payroll processing, trade settlement, and remittances. Additionally, they now offer yield opportunities, either natively or through decentralized finance (DeFi) protocols. In emerging markets, stablecoins are gaining traction for payments, currency substitution, and accessing higher quality yield options.

Stablecoins are predominantly tied to the US dollar, with the Euro being the second most popular, accounting for just 0.38% of the total market as of June 2024, with a supply of $617 million.

While other currencies like the Lira, Singapore Dollar, and Yen are also referenced by stablecoins, none have more than $100 million in supply outside of the dollar and Euro.

Nigeria Tops in Stablecoin Adoption

Nigeria, whose population was 233.7 million as of September 23, has been a global leader in cryptocurrency adoption over the past few years.

However, one trend stands out in the report. Nigeria’s growing affinity for stablecoins means it leads the five markets studied in terms of stablecoin adoption.

As inflation and currency volatility plague the nation’s economy, stablecoins have become a vital tool for Nigerian consumers, businesses, and investors seeking financial stability and flexibility.

SOURCE: VISA Stablecoin Report in Emerging Markets

Nigeria’s economy has been dealing with a series of shocks in recent years. Depressed oil prices, a staple of the nation’s export economy, combined with the impact of COVID-19 and supply chain disruptions, have led to prolonged economic uncertainty.

Additionally, the naira has experienced significant depreciation against major world currencies, forcing Nigerian consumers and businesses to seek more reliable alternatives for preserving wealth and transacting across borders.

Inflation, which was recorded at around 32% in July 2024, has eroded purchasing power for many Nigerians. In response, stablecoins offer a critical hedge against inflation and currency fluctuations. They provide Nigerian users with an easy-to-access financial instrument that holds value better than the naira while allowing for seamless cross-border transactions.

The report, without indicating data, notes that Nigerian users stand out for their frequent transactions, with stablecoins making up the largest portion of their portfolios. They also report the highest percentage of non-trading uses for stablecoins and demonstrate the strongest self-reported understanding of them.

Interestingly, the primary motivations for stablecoin use vary across countries. For Nigerians, saving in dollars is the primary goal, followed by trading crypto and securing better currency conversion rates.

In Turkey, earning yield is the top priority, followed by trading crypto. Indonesians prioritized better currency conversion rates, then trading crypto and saving in dollars.

The most active countries for stablecoin usage after Nigeria are India, Indonesia, Turkey, and Brazil. In terms of stablecoin portfolio share, Nigeria leads by a wide margin, followed by India, Turkey, Brazil, and Indonesia.

Of all the platforms studied for stablecoin transactions, Ethereum stands out as the dominant blockchain, solidifying itself as the backbone of the stablecoin economy. “After denoising, the most popular blockchains by value settled as of June 2024 are Ethereum, Tron, Arbitrum, Coinbase’s Base, Binance Smart Chain, and Solana, in order,” states the report.

Ethereum was one of the earliest blockchains to support smart contracts, allowing for the creation of decentralized applications (dApps) and programmable digital assets. This early development fostered the creation of several major stablecoins, such as Tether (USDT), USD Coin (USDC), and DAI, on the Ethereum network. As these stablecoins gained adoption, Ethereum’s blockchain became the default platform for their transactions.

Ethereum boasts the largest ecosystem of developers, projects, and tools in the blockchain space. Stablecoins benefit from this wide support as they are easily integrated into decentralized applications, DeFi protocols, and decentralized exchanges (DEXs) built on Ethereum. The proliferation of these platforms has expanded the use cases for stablecoins, making Ethereum the central hub for blockchain-based finance.

SOURCE: VISA Stablecoin Report in Emerging Markets

Ethereum’s smart contract capabilities allow stablecoins to be more than just a digital representation of fiat. With smart contracts, stablecoins can be programmed for specific uses, such as collateral in lending platforms, or to execute automated payments in decentralized applications. This programmability has revolutionized the way financial services operate, especially in DeFi, where stablecoins serve as the lifeblood of many protocols.

Ethereum’s large user base and active trading environment create liquidity for stablecoins. Whether it’s DeFi transactions or everyday payments, Ethereum’s network effects—where the value of the blockchain grows with increased usage—ensure that stablecoins on Ethereum enjoy unparalleled liquidity. This network effect makes Ethereum the most attractive blockchain for stablecoin issuers and users alike.

However, the report ranks the most popular blockchains for sending stablecoins as Tron, Binance Smart Chain, Polygon, Solana and Ethereum. “The generally higher fee burden on Ethereum means that there tend to be fewer addresses transacting and fewer transactions than Tron or Binance Smart Chain, but Ethereum is still the leader in value settled,” the report explains.

Most People Use Stablecoins for Crypto Trade and Currency Conversion

While the study found out the most common goal among stablecoin users was trading crypto or NFTs, non-crypto uses were also significant. In total, 47% of respondents cited saving money in dollars as a primary objective, 43% aimed for better currency conversion rates, and 39% focused on earning a yield.

This means the most popular non-crypto use case for stablecoins is currency conversion, according to the report, allowing people around the world to seamlessly exchange value across borders without the friction of traditional banking systems. This trend is driven by the unique advantages that stablecoins offer in comparison to conventional currency exchange methods.

SOURCE: VISA Stablecoin Report in Emerging Markets

Traditional methods of currency conversion often involve banks, payment providers, or exchange services that charge high fees and impose long waiting times. Stablecoins address many of these pain points, making them the preferred choice for an increasing number of people worldwide.

Traditional international bank transfers can take days to complete, with each intermediary adding to the processing time. Stablecoin transactions, on the other hand, settle in minutes, regardless of the sender’s or receiver’s location. This speed is particularly important in fast-moving markets, where exchange rates fluctuate and people need to convert currencies quickly.